Often abbreviated as “liquid staked tokens,” are blockchain assets that represent a user’s stake in a proof-of-stake (PoS) network while maintaining liquidity and fungibility. They allow holders to retain the benefits of staking, such as earning rewards and participating in network security, while simultaneously having the flexibility to trade or use the tokens without waiting for staking lock-up periods. These tokens are typically issued on secondary markets by specialized platforms, bridging the gap between the illiquid nature of traditional staking and the fluidity of cryptocurrency trading. Liquid staking tokens provide a novel way for users to balance the desire for staking rewards with the need for liquidity and trading opportunities within the rapidly evolving decentralized financial landscape.

The Origins of All Staking: Proof-Of-Stake

Proof-of-stake blockchains need members to put up a specific amount of money to act as collateral in order to validate transactions and build blocks. Crypto staking is the term for this. You can no longer spend your money on blockchain applications or services due to native staking, though. In essence, the currencies are secured to ensure that a blockchain validator behaves in the network’s best interest. It is critical that the network has access to these currencies because if they act inappropriately, they forfeit their “stake.” But the narrative is not over yet.

Because of the substantial amount of liquidity that this technique needs users to lock up, crypto developers devised a means to overcome this drawback. There is now a creative way to use these currencies in the blockchain ecosystem going forward without losing your investment. Additionally, you can still get the benefits. But how on earth is that meant to function?

Simply put, this process is known as “liquid staking,” and it enables you to use the same cash in DeFi protocols and blockchain applications while earning incentives for protecting blockchains. But what precisely is it, and how does it operate?

What Is Liquid Staking?

Liquid staking, like native staking, requires users to deposit their tokens into a smart contract on the liquid staking platform. They essentially provide liquidity to that reserve.

The largest distinction, though, is what occurs next. To clarify, liquid staking systems provide the staker with independent tokens, which function similarly to a receipt for their stake. These assets are known as Liquid Staking Tokens (LSTs) or Liquid Staking Derivatives (LSDs), and they are linked to the initial asset’s value. The intriguing aspect of these receipt tokens is that they are identical to any other blockchain token. Yes, they can be used in DeFi protocols and blockchain apps. But there’s a little more to it than that—let’s have a look at how it works.

How Does Liquid Staking Work?

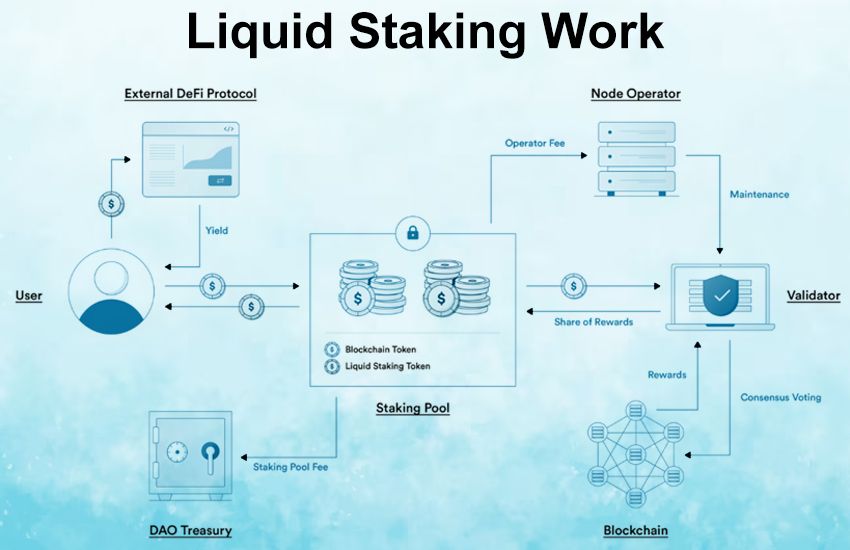

Simply put, there are three major stages in liquid staking: staking the asset, issuing liquid staking tokens (or LSTs), and lastly, unstaking. It appears straightforward, and for the most part, it is. So, let’s examine how these processes interact to deliver extra liquidity to stakeholders.

Keep in mind that you still gain benefits from your staked funds, but with liquid staking, you can now use those tokens for other purposes. These liquid staking tokens (LST) can subsequently be transferred out of the platform, stored elsewhere, traded, or spent without affecting the initial deposit. To get access to your original holding, you must first trade the tokenized versions of the same value.

A liquid staking protocol chart is shown below, along with how LSTs can be employed in external DeFi projects.

Staking

Staking Sending coins to the user’s preferred platform—in this example, a liquid staking platform—is the same as starting a native staking process. The tokens will then be stored in a smart contract after the platform has confirmed their authenticity. But this is where the approaches divide. To further clarify, the platform then issues LSTs to users in place of the initial assets.

But happens, though, to all of those risked assets?

Simply put, the platforms for liquid staking employ this money for native staking after that. This indicates that they employ your money to secure a proof-of-stake blockchain for which it is rewarded with freshly created cryptocurrency. Users who stake assets on the platform receive a share of these incentives on a recurring basis from the platform. These prizes are then given to users in the form of additional tokens (LSTs).

DeFi enthusiasts will undoubtedly like this since it signifies that the liquid staker still has receipt assets at his disposal for trading. Additionally, they get a modest bonus on top of what they invested, which is another easy method to get some passive income.

What are LSTs?

Understanding these receipt tokens comes next. As already noted, liquid tokens, liquid staking tokens (LSTs), or liquid staking derivatives (LSDs) are simply blockchain receipts that demonstrate your ownership of a staked digital asset. Additionally, their worth is linked to that of the original item. LSTs are appropriate for a variety of uses inside the DeFi ecosystem, just like any other blockchain asset. For instance, you may exchange them for other crypto tokens or engage in trade with them.

LSTs can really be used as collateral for other token loans as well as lending. They can be helpful for a variety of reasons and are essentially tokenized assets. There are countless potential use cases, making it hard to discuss them all in one article.

The liquid staking token for Ether, stETH, is a nice illustration of an LST. These days, this is one of the most well-liked coins, and there are several DeFi protocols and blockchain platforms where it can be found.

Unstaking

What happens then if a user requests their money back? The unstaking procedure is used in this situation. To put it simply, a user must burn their liquid staking tokens (LSTs) in order to unstake their funds. The site will often ask the user to transmit the tokens to a specified address in order to do this.

The staking platform then checks the transaction on-chain to confirm that the assets have been burnt. The user receives his or her freshly unstaked coins if the transaction is legitimate. That’s actually how easy it is. It’s vital to keep in mind, though, that doing so often incurs a price, and it’s not always cheap.

Advantages of Liquid Staking

So now that you are aware of what liquid staking is, what are some of its advantages? Let’s look at some of the many excellent reasons to utilize liquid staking platforms.

- Accessibility

Accessibility is a major benefit of liquid staking. To clarify, there is no unbonding period. Thus, when customers unstake, they receive their staked assets back right away. To be clear, the majority of staking platforms will have a bonding time, which might mean that you will have to wait days or weeks to get your staked tokens back. - Liquidity

Liquidity is the main benefit of liquid staking; staked tokens may be used just like any other digital asset. That implies that you can continue to sell, trade, or even give away your tokens. Liquid staking allows you to utilize reception tokens (or LSTs) for other purposes, whereas traditional staking locks these assets up in a smart contract. This gives the user greater liquidity, and who wouldn’t want more of that? - The DeFi Composability

In addition to being appropriate for selling, receipt tokens used for liquid staking may also be utilized on a variety of DeFi sites. Defi composability refers to this. To give one example, you might lend LSTs to other cryptocurrency users or even borrow other digital assets using your LSTs as security. With staked tokens, this opens up a whole new universe of utility. - Rewards

Increased payouts are one of the most significant advantages of liquid staking. To begin, you are rewarded just for liquid staking. Then, because you can utilize your receipt tokens in DeFi, you may boost your benefits without investing further assets. Assume you staked 1ETH on a liquid staking platform and received LSTs in exchange. You will receive incentives for staking the original tokens, but you may also utilize these LSTs to earn even more rewards on other staking sites. If done correctly, you may generate far more passive income on the same investment than traditional finance or interest via banking services.

The disadvantages of Liquid Staking

Of course, with all of the benefits of liquid staking, there are some drawbacks. Let’s take a look at some of the hazards associated with using liquid staking platforms.

- Exploits

To begin, liquid staking entails transferring the original assets to a smart contract. Unfortunately, this can be a problem because clever contact flaws might expose money to exploitation. For example, if a bad actor discovers an error in the contract code, they may quickly exploit it and gain access to the cash. - Price volatility

Next, there is the possibility of price volatility with liquid staking. To clarify, because LSTs are tied to the price of an asset via a smart contract, there is a possibility that the token will depend. When an asset depends, it loses the same value as the asset it represents. If your LSTs are less valuable than the assets they represent, you may be losing money unknowingly! - Punishment Via Slashing

Using liquid staking platforms implies that you don’t have to put up large sums of money to get the benefits of establishing a proof-of-stake network. However, this implies that you are putting your faith in the platform’s validators. If they decide to try to game the system, their investment and your share of the profits will be reduced. - Fees

Finally, liquid staking often incurs a charge, which varies by platform. Although there are several advantages to using liquid staking platforms, the costs are typically greater than with other methods of staking and may be a barrier to some. So, before you start earning incentives, consider whether they exceed the costs you’ll have to pay.

Liquid staking pros and cons

Pros:

- Liquidity: Liquid staking allows you to keep your staked tokens liquid, meaning you can still trade them or use them to participate in other DeFi applications. This is in contrast to traditional staking, where your tokens are locked up for a period of time.

- Yield: Liquid staking can offer similar or even higher yields than traditional staking. This is because liquid staking platforms often use sophisticated strategies to maximize returns.

- Convenience: Liquid staking is a more convenient way to stake your tokens. You don’t need to worry about setting up and maintaining a staking node.

Cons:

- Risk: Liquid staking platforms are still relatively new, and there is some risk involved. For example, if the platform is hacked, you could lose your staked tokens.

- Fees: Liquid staking platforms typically charge fees for their services. These fees may differ depending on the platform.

- Complexity: Liquid staking can be more complicated than regular staking. You need to understand how the platform works and the risks involved.

Staking Vs. Liquid Staking: What’s the Difference

Staking is the process of locking up your cryptocurrency tokens in order to help secure a blockchain network. In return for staking your tokens, you will earn rewards, typically in the form of more tokens.

Liquid staking is a newer way to stake your tokens that allows you to keep your tokens liquid, meaning that you can still trade them or use them to make payments. With liquid staking, you delegate your tokens to a validator who will stake them on your behalf. In return, you will earn rewards, just like with traditional staking.

Here is a table summarizing the key differences between staking and liquid staking:

| Factors | Staking | Liquid Staking |

|---|---|---|

| Purpose | Secure the blockchain network | Earn rewards |

| Lockup period | Typically 24 hours or more | No lockup period |

| Liquidity | Tokens are illiquid | Tokens are liquid |

| Risk | Higher risk of losing tokens if the network is attacked | Lower risk of losing tokens |

| Rewards | Typically lower rewards | Typically higher rewards |

Conclusion

Liquid staking tokens represent a novel financial instrument that bridges the gap between staked assets on blockchain networks and their liquidity needs. These tokens are issued when users stake their cryptocurrency assets to support network operations like proof-of-stake. They can then trade or use these tokens in decentralized finance (DeFi) protocols, unlocking the value of their staked assets without sacrificing network participation. By enhancing asset utility and enabling greater flexibility, liquid staking tokens contribute to a more efficient and versatile blockchain ecosystem.

FAQs

Q. What is the fee for liquid staking?

A. Liquid staking fees vary depending on the platform or service you use. These fees typically encompass network fees, validator commissions, and any additional charges imposed by the staking platform. The exact fee structure can differ significantly between different cryptocurrencies and staking providers, so it’s essential to research and compare options before engaging in liquid staking.

Q. What are the risks of staking crypto?

A. Staking crypto involves risks such as potential loss of principal due to market volatility, slashing penalties for network rule violations, and potential technological vulnerabilities leading to hacks. Additionally, staking rewards can vary and may not always outweigh the associated risks. It’s crucial to thoroughly research and understand the specific project’s staking mechanism before participating.

Q. Does staking increase liquidity?

A. Yes, staking can increase liquidity in certain cases. When users stake their cryptocurrency assets in a liquidity pool, it provides collateral for decentralized exchanges, allowing for trading without relying on traditional order books. This can enhance overall market liquidity by enabling smoother trades and reducing slippage. However, the impact on liquidity varies depending on the specific staking mechanism and the overall demand for the assets involved.

Q. Is staking tax-free?

A. Staking may have tax implications depending on your jurisdiction. In some places, staking rewards could be considered taxable income, similar to interest. However, tax laws vary, and factors such as the nature of the staked tokens and local regulations can influence taxation. It’s advisable to consult a tax professional or authority in your area to understand the specific tax treatment of staking in your situation.

Q. How much can I earn from staking?

A. The earnings from staking can vary widely depending on factors such as the cryptocurrency being staked, the staking rewards offered by the network, and the amount of tokens you stake. Generally, staking can yield annual returns ranging from a few percent to potentially over 10%, but it’s important to research and consider the associated risks before participating in any staking activity.