ETFs (exchange-traded funds) are versatile and adaptable investing tool that comes in a variety of formats. These financial instruments give investors exposure to a wide range of assets and strategies, catering to a wide range of investor preferences and objectives. Investors may choose from a variety of ETFs based on their risk tolerance and personal financial goals.

ETFs provide options for risk management, income creation, sector-specific investment, diversification, and much more. By selecting the suitable type of ETF, investors may build a well-rounded and customized portfolio that meets their own investing strategy.

What Are ETFs?

Exchange-traded funds are investment vehicles that are exchanged on stock exchanges. They allow investors to hold a range of assets, such as stocks, bonds, commodities, or digital currencies, all inside the confines of one fund. ETFs frequently comprise a mix of assets, which helps to spread risk over a wide range of investment categories.

In addition to diversity, ETFs provide liquidity. They can be purchased and sold at market prices at any moment throughout the trading day, allowing investors flexibility. The liquidity of ETFs is one of the key qualities that distinguishes them from traditional mutual funds.

A subclass of ETFs known as “crypto ETFs” provides exposure to digital currencies. Rather than purchasing individual cryptocurrencies such as Bitcoin BTC, investors can purchase shares in a fund that holds a variety of digital assets. BTC $34,898 or Ether ETH $1,881, which might help reduce danger. The regulatory landscape for bitcoin ETFs, on the other hand, is complicated and varies by country.

For example, Canada is much ahead of the curve, having approved many Bitcoin and Ether ETFs. In addition, the United States Securities and Exchange Commission (SEC) authorized the first Bitcoin futures ETFs in October 2021 after years of high anticipation and several denials of Bitcoin ETF applications.

How Do ETFs Work?

ETFs work via a simple method including many critical components, which include:

The Creation Of The Fund

The process begins when a company, often a financial institution or asset management business, decides to launch an ETF. They create a basket of assets as the ETF’s underlying holdings, which may include securities such as equities, bonds, commodities, or other financial instruments.

Getting Regulatory Approval

Before an ETF may be marketed to the public, the sponsoring firm must get regulatory clearance from the proper authorities, such as the SEC in the United States. Regulatory bodies ensure that the ETF complies with all applicable rules and regulations.

Creation And Redemption

ETF shares are issued and redeemed through a process involving authorized participants (APs). Those are large financial institutions or market makers who have been granted authorization to participate in the creation and redemption process.

An AP collects the requisite assets (typically in-kind) and delivers them to the ETF issuer in order to construct new ETF shares. In exchange, customers receive a set number of ETF shares. When an AP wants to redeem ETF shares, they return the shares to the issuer and get the underlying assets.

Trading On Stock Exchanges

Shares of the ETF, like individual shares, are traded on stock markets after they are established and in the hands of investors. During regular trading hours, investors can buy and sell ETF shares at market prices. Investors profit from the liquidity and flexibility this provides.

ETFs calculate their net asset value at the end of each trading day. This is computed by dividing the fund’s total asset value by the number of outstanding shares. Because of the formation and redemption processes, the market price of ETF shares is often close to the net asset value (NAV).

An arbitrage mechanism can be utilized to keep the ETF’s market price in line with its NAV.

Through the process of issuing and redeeming ETF shares, an arbitrage mechanism may be utilized to keep the ETF’s market price in line with its NAV. Authorized participants may buy or sell shares when the ETF’s market price differs from its NAV in order to profit from price differences and keep the ETF’s market price close to its NAV.

ETFs Types

Traditional ETFs and crypto ETFs are two types of ETFs. Traditional or conventional ETFs are exchange-traded funds that provide exposure to several asset classes, such as stocks, bonds, and commodities. These ETFs follow and provide exposure to traditional financial goods and markets in accordance with the traditional concept.

Crypto ETFs, on the other hand, are a relatively new phenomenon, consisting of a special category of exchange-traded funds that provide exposure to digital currencies such as Bitcoin or a basket of cryptocurrencies. Conventional ETFs are more established and provide a greater range of traditional asset types and investing strategies.

Traditional ETFs

Equity ETFs

Equity ETFs, which provide exposure to individual companies, stock indexes, or specific industrial sectors, are the most popular type of exchange-traded fund. Investing in an ETF that tracks the S&P 500 or a sector-specific ETF that focuses on technology companies are two investing alternatives in this area.

Fixed-Income ETFs

Bonds and other fixed-income instruments are held by fixed-income exchange-traded funds. They give diversified exposure to a wide range of bond categories, including high-yield bonds, corporate bonds, municipal bonds, and government bonds.

Commodity ETFs

Commodity ETFs are ETFs that provide exposure to actual commodities such as gold, silver, oil, and agricultural products. Some of these ETFs own tangible assets or futures contracts, while others track commodity prices.

Currency ETFs

Currency ETFs enable investors to trade international exchange rates or gain exposure to a certain currency. Currency futures contracts are typically used by these ETFs to imitate the movements of a currency pair.

Environmental, Social, And Governance (ESG) ETFs

ESG ETFs incorporate environmental, social, and governance considerations into their investing criteria. They prioritize firms with good environmental and ethical standards.

ETFs For Real Estate

Real estate investment trusts (REITs) and real estate companies are ETFs that specialize in real estate investments. They provide exposure to the real estate market without actually owning any real estate.

Inverse ETFs

These funds attempt to profit when the value of the underlying asset or index falls. They employ derivatives and other tactics to obtain inverse returns.

Leveraged ETFs

These exchange-traded funds provide twice or three times the exposure to the underlying index by employing financial derivatives to improve returns. They are risky and geared for short-term trading.

Thematic ETFs

ETFs labeled “thematic” are ones that focus on specific investing topics or trends rather than broad market indexes or asset classes. These exchange-traded funds seek to expose investors to firms, sectors, or trends connected with a given theme, such as renewable energy, artificial intelligence, robotics, cybersecurity, e-commerce, and cannabis.

Crypto ETFs

Crypto Index ETFs

These ETFs attempt to replicate the performance of a certain cryptocurrency index, such as the Bloomberg Galaxy Crypto Index. They give a variety of exposure to the index’s several cryptocurrencies.

Altcoin ETFs

Altcoin ETFs are exchange-traded funds that track a range of cryptocurrencies other than Bitcoin. The goal of altcoin ETFs is to provide investors with diversification across a variety of cryptocurrencies, as various cryptocurrencies may have distinct price movements and fundamentals.

Bitcoin ETFs

These ETFs are only focused on Bitcoin, the most well-known cryptocurrency. Such ETFs provide investors access to Bitcoin price changes without forcing them to own the cryptocurrency altogether.

ETFs For Blockchain

These ETFs invest in firms that use blockchain technology, although they are not only bitcoin ETFs. They give an indirect exposure to the blockchain ecosystem despite owning any cryptocurrencies.

How To Invest In ETFs

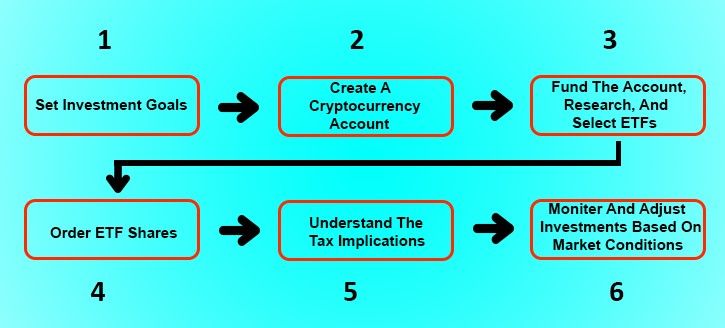

Investing in ETFs is a systematic technique that can be used for both regular and cryptocurrency ETFs. Setting financial goals, opening a brokerage account, funding the account, conducting research, selecting ETFs, placing orders, keeping track of investments, staying informed, and reevaluating and adjusting the investment strategy on a regular basis are all steps involved in investing in traditional exchange-traded funds.

A similar set of procedures applies to investing in exchange-traded funds (ETFs): goal-setting, opening a brokerage account dedicated to cryptocurrency, funding the account, investigating and choosing ETFs, ordering shares, tracking and modifying investments, comprehending tax implications, implementing security measures, and remaining up to date on the volatile cryptocurrency market.

Benefits And Drawbacks Of ETFs

ETFs provide a lot of benefits. They reduce risk by providing investors with the opportunity to allocate their capital across a range of assets, providing diversification. ETFs are very liquid so investors may buy or sell shares quickly and easily. The openness of ETFs is a notable benefit; they make their holdings available to the public every day, enabling educated investing decisions.

Their cost-effectiveness often results from modest fees, which lessen investors’ financial strain. Additionally, exchange-traded funds lessen capital gains distributions, which lowers tax requirements due to the way they are set up. Exchange-traded funds are a popular choice for investors seeking a diversified, cost-effective, and tax-efficient portfolio because of these advantages.

On the other hand, ETFs have disadvantages. Due to the possibility of value swings, investors are exposed to market risks. Due to tracking issues, an ETF’s performance may deviate from the index it is intended to represent, thus affecting returns. Trading expenses, including fees and bid-ask spreads, can cut profits, particularly for long-term traders.

Certain ETFs, especially those associated with cryptocurrency, can be intricate and challenging to understand. With bitcoin exchange-traded funds, there is a risk of default by the company providing the derivative, which might lead to losses. The adaptability of ETFs has cemented their position in both established and developing markets, notwithstanding these drawbacks.

Conclusion

Exchange-traded funds come in a wide array of types and strategies, making them versatile tools for investors. Whether you’re seeking equity exposure, fixed income, commodities, or specific investment styles, there is likely an ETF that suits your needs. As with any investment, it’s essential to thoroughly research and understand the characteristics and risks associated with each type of ETF before adding them to your portfolio. ETFs offer a convenient and cost-effective way to build a diversified investment portfolio and adapt to various market conditions, making them a valuable asset for investors of all levels of expertise.

ETF’s

Q. What is ETF’s full form?

A. ETF stands for “Exchange-Traded Fund.” It is a type of investment fund and exchange-traded product with shares that are traded on stock exchanges, similar to individual stocks. ETFs typically aim to track the performance of a specific index, commodity, bond, or basket of assets. They offer investors diversification and liquidity while providing a cost-effective way to invest in various financial markets.

Q. What is the most common type of ETF?

A. The most common type of ETF (Exchange-Traded Fund) is the equity ETF. These funds track stock market indices, such as the S&P 500, and aim to replicate their performance. Equity ETFs offer investors a diversified portfolio of stocks, providing exposure to a broad range of companies and sectors. They are popular due to their liquidity, low expense ratios, and ease of trading on stock exchanges.

Q. What is ETF and its features?

A. An ETF, or Exchange-Traded Fund, is a financial investment vehicle that combines the features of a mutual fund and a stock. It allows investors to buy and sell shares representing ownership in a diversified portfolio of assets like stocks, bonds, or commodities. ETFs are traded on stock exchanges, providing liquidity, transparency, and low expense ratios. They offer diversification, flexibility, and the ability to track specific indices or asset classes, making them a popular choice for investors seeking broad exposure to various markets.

Q. How many ETFs are good?

A. The number of ETFs to include in your investment portfolio depends on your financial goals, risk tolerance, and diversification strategy. A well-diversified portfolio typically includes a range of ETFs covering various asset classes, sectors, and regions. Many investors find that a mix of 5-15 ETFs is sufficient to achieve diversification while keeping their portfolio manageable and cost-effective. It’s essential to align your ETF selection with your specific investment objectives and risk profile.

Q. Who are ETF sponsors?

A. ETF sponsors are financial firms responsible for creating, registering, and administering exchange-traded funds (ETFs). They play a crucial role in overseeing the ETF’s operations, managing the fund’s portfolio, and ensuring compliance with regulatory requirements. Prominent ETF sponsors include BlackRock, Vanguard, State Street Global Advisors, Invesco, and Charles Schwab, among others. They provide investors with a diverse range of ETF options across various asset classes and investment strategies.